Rulemaking Notice: Dual Notice in State Register on April 22

The Board will publish in the April 22, 2024, issue of the State Register a Dual Notice of Intent to Adopt Rules Without a Public Hearing Unless 25 or More Persons Request a Hearing, And Notice of Hearing if 25 or More Requests for Hearing Are Received for rule package R-04851, which proposes rules related to examination credit requirements and continuing professional education late processing fees.

For the text of the proposed rules, the dual notice text, and the the Board's Statement of Need and Reasonableness, see the Board's rulemaking page.

Rulemaking

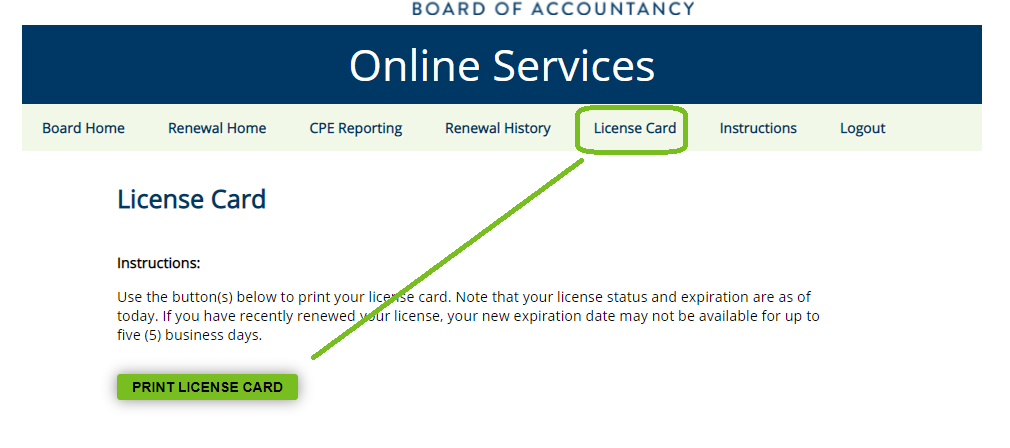

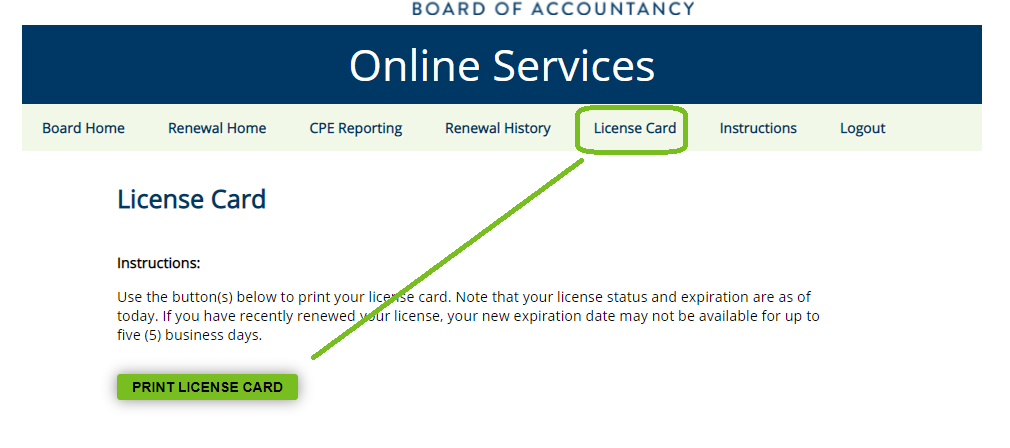

License Cards for Current CPA Licensees and SP Firms Available Through Online Services

The Board does not mail license or permit cards upon renewal. Current Active and Inactive status licensees may instead log into Online Services and print a PDF version of their license card. Sole proprietors whose firm permit number is the same as their individual license number can also print a copy of their firm permit.

Log in to Online Services, then select the "License Card" tab (see image). If a card is available, you will see a "print" option. Note that if you have only just recently renewed or become licensed, the card may not be available (or may not show your new expiration date) for 3-5 business days.

When you select "print" a PDF is generated. Where the file saves or how it displays will depend upon the browser/browser settings you use. Lines on the 8 1/2 x 11 printout indicate where to cut to create the traditional oversized and wallet-sized cards.

No license/permit cards are available for CPA firms or RAPs/RAP firms. To verify your status and expiration, use Find a CPA (individuals) and Find a CPA Firm (CPA and RAP firms).

Get Renewed for 2024 ASAP!

All licenses and permits dated 12/31/2023 have expired. There is no grace period with license or permit expiration. You must be in compliance with Minnesota rules and statutes to hold out or practice.

To renew for 2024, use the appropriate PDF form available in the "Forms" section of the website. Complete and mail in with your check or money order. (Only Inactive status renewing as Inactive can still use Online Services.)

If you wish to go Exempt or Retire, or are seeking Reactivation or Reinstatement, see the separate (not Renewal) forms for those statuses/processes in the "Forms" section of the website.

All late renewals or status changes must pay a $50 delinquency fee (per year of expiration), in addition to any license/permit fee.

Those earning and/or submitting CPE late (including those late in reporting exemption from CPE reporting) also have CPE late fees. These accrue monthly, based on the postmarked date the Board receives your certificates of completion and fee. See the CPE chart below for details.

A special reminder to firm owners that 100% of Minnesota-licensed owners must be renewed by March 1, 2024, or the 2024 permit is REVOKED.

Rule Changes Effective October 9

Several changes regarding Minnesota Rules, Chapter 1105, were adopted by the Board and became effective October 9, 2023. In addition to minor housekeeping items and updates to documents incorporated by reference, changes include:

- changes necessitated by the addition of “retired status” and the removal of “automatic revocation” from Minnesota Statutes, Chapter 326A;

- requirements for continuing professional education (CPE), including CPE requirements for status change;

- requirements for the composition of the peer review oversight committee;

- validity dates for applications for individual and firm permits;

- requirements related to providing verified experience for licensure;

- requirements for notification by firms of changes to firm ownership, status with the Office of the Secretary of State to operate as a registered business entity, and dissolution/termination of the firm;

- minimum requirements for the retention of documents related to professional services other than audit; and

- update definitions related to education and continuing education examination.

For the authoritative version of Minnesota

Rules, Chapter 1105, see the Revisor's website. Note: There may be a delay before the rule changes are live. The Board has prepared an overview of those changes most likely to be of interest to applicants, licensees, and firms.

Lifson, Moore, and Rosenwald Appointed to the Board

On May, 4, 2023, Governor Tim Walz appointed Todd Lifson, CPA, to a four-year term with the Board of Accountancy.

Mr. Lifson is a Partner with EisnerAmper and has more than thirty years of

comprehensive business experience. He specializes in highly complex audit, tax, and merger acquisition engagements. Mr. Lifson is also an advisor to many boards of clients, helping

them navigate primarily financial matters and advising on operational items, succession issues, leadership changes, and

growth strategies. He has worked with the Financial Accounting Standards Board’s (FASB) Emerging Issues Task Force

(EITF) and served as a project manager for the development of a Securities and Exchange Commission (SEC) manual.

On June 30, 2023, Governor Tim Walz appointed Douglas Moore and Diane Rosenwald to four-year terms with the Board of Accountancy as Public Members.

Mr. Moore held finance roles supporting functions at large and midsized corporations in the Twin Cities for more than 20 years. These assignments frequently brought him into contact with members of the accounting profession for audit and consulting work from a customer

point of view. For more than 10 years he has also volunteered as a tax preparer and reviewer in the IRS Volunteer Income Tax Assistance program. The experience showed Mr. Moore how necessary good

financial services are to Minnesotans across the socioeconomic spectrum.

Ms. Rosenwald received her Bachelor of Arts degree from the University of Minnesota, Morris, and did graduate studies in food science at the University of Minnesota, St. Paul. In her extensive career as a food scientist at Pillsbury and General Mills, she has been awarded over a dozen patents and was a technical lead on the teams that created and implemented electronic laboratory notebooks (scientific research records) at both Pillsbury and General Mills. Ms. Rosenwald has over 15 years of volunteer experience with Prepare + Prosper (formerly Accountability MN) preparing and reviewing standard and self-employment tax returns.

Selcer Reappointed to the Board

On May, 4, 2023, Governor Tim Walz reappointed Charles Selcer, CPA, to another four-year term with the Board of Accountancy.

Mr. Selcer currently serves as Board Chair. He is a shareholder in Schechter

Dokken Kanter Andrews & Selcer Ltd. Mr. Selcer has served on

the MNCPA Ethics Committee and

the AICPA Technical Subcommittee (Ethics). He is a former recipient of MNCPA’s R.

Glen Berryman Award.

Board Approves CPA Exam "Transition" Credit Extension

The Board voted at the September 2022 meeting to automatically extend section credits for anyone sitting for the exam as a Minnesota candidate with UNEXPIRED credits as of January 1, 2024. The expiration date for those "as of January 1, 2024 unexpired" credits will be extended through June 30, 2025.

Minnesota candidates to whom this would apply will not need to request an exception from the Board; the extension will be automatically granted.

The move, being undertaking by other state boards as well, is to ease the transition from the current Uniform CPA Exam format and structure to the new exam. See the NASBA Credit Extension Map for more details on other states granting extensions.

Beware of Email Phishing

The Minnesota Board has learned that a phishing message claiming to be from the Minnesota Board regarding "licensee fee changes" has been circulating. The Board sent no such message (and there are no fee increases). If received, follow the best practices at your firm for dealing with suspicious emails.

Continuing Professional Education Reporting Fee Chart

Either the left or the right fee column for any given year will apply. If you are noncompliant in more than one year; you owe the applicable fee for each year.

Examples (rates valid only for APRIL 2024):

• Failed to complete CPE for reporting year FY23 on time (6/30/2023): $275.

• Failed to complete CPE for FY22 on time (6/30/2022): $575.

• Earned FY23 on time but reported late (after 12/31/23) and failed to complete FY22 CPE on time (6/30/22): $700.

|

| Reported CPE late but earned the CPE during the proper timeframe, use these columns: |

|

Failed to complete CPE in proper timeframe (and so also did not report it on time), use these columns: |

| Failed to report CPE by*: |

Fee is: |

Submit: |

Failed to complete CPE by**: |

Fee is: |

| 12/31/23 |

$125 |

Certificates of completion for only those hours earned after 6/30/2023 and required fees** |

06/30/23 |

$275 |

| 12/31/22 |

$425 |

Certificates of completion for only those hours earned after 6/30/2022 and required fees** |

06/30/22 |

$575 |

| 12/31/21 |

$725 |

Certificates of completion for only those hours earned after 6/30/2021 and required fees** |

06/30/21 |

$875 |

|

* If a non-Minnesota resident claiming exemption from CPE reporting under MN Rule 3100, Subp. 3, you must claim the exemption by the reporting deadline or be subject to the same fees as those late reporting hours.

** If you completed CPE hours after the earning deadline(s), you must include copies of the certificates of completion for those hours. |