Renew Your License for 2026 ASAP!

All licenses and permits dated 12/31/2025 have expired. There is no grace period with license or permit expiration. You must have a current license to hold out or practice.

To renew your individual license or firm permit for 2026, you must use the appropriate "2026 and prior..." PDF paper form available in the "Forms" section of the website*. Complete the appropriate form(s) and mail in with your check or money order - the Board is unable to accept cash, credit card, or other electronic forms for payment for LATE renewals. (* Only Inactive status renewing as Inactive can still use Online Services.)

If you wish to go Exempt or Retire, or are seeking Reactivation or Reinstatement, see the appropriate forms for those status changes in the "Forms" section of the website.

All late renewals or status changes must pay a $50 delinquency fee (per year of expiration), in addition to any license/permit fee.

Those earning and/or submitting CPE late (including those late in reporting exemption from CPE reporting) also have CPE late fees. These accrue monthly, based on the postmarked date the Board receives your certificates of completion and fee. See the CPE chart below for details.

Reminder to firm owners: 100% of Minnesota-licensed owners must be renewed by March 1, 2026.

UPDATE: New Pathway to CPA Licensure

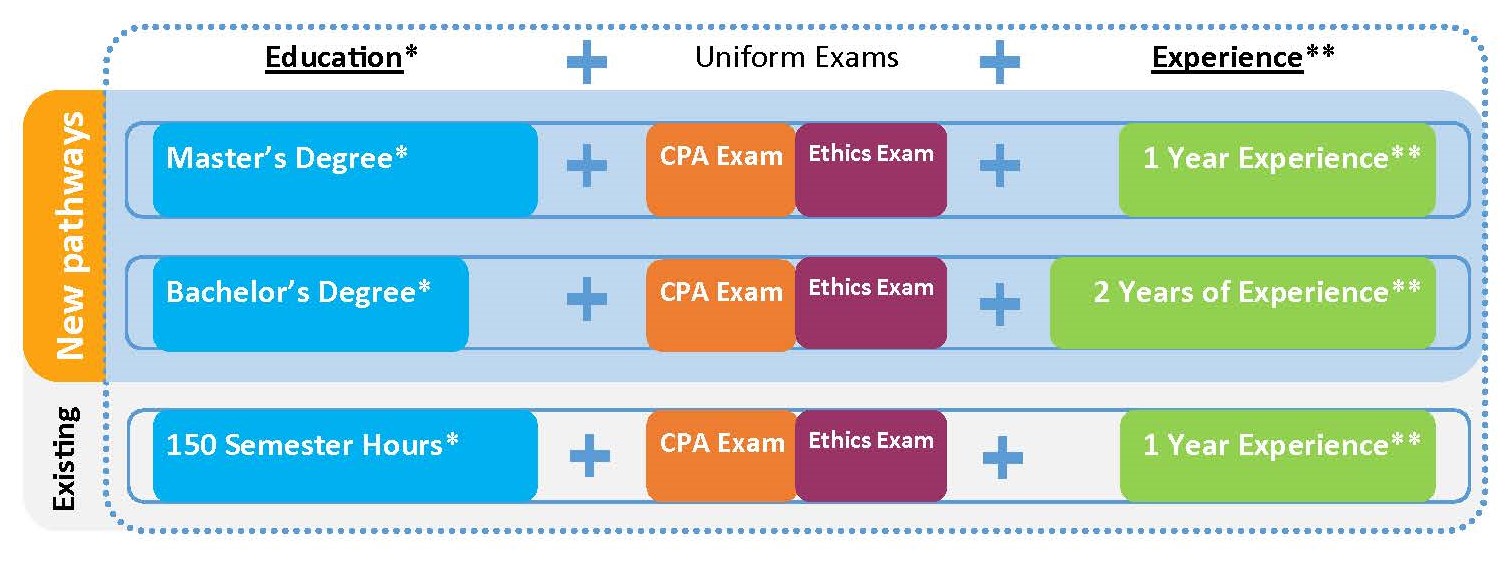

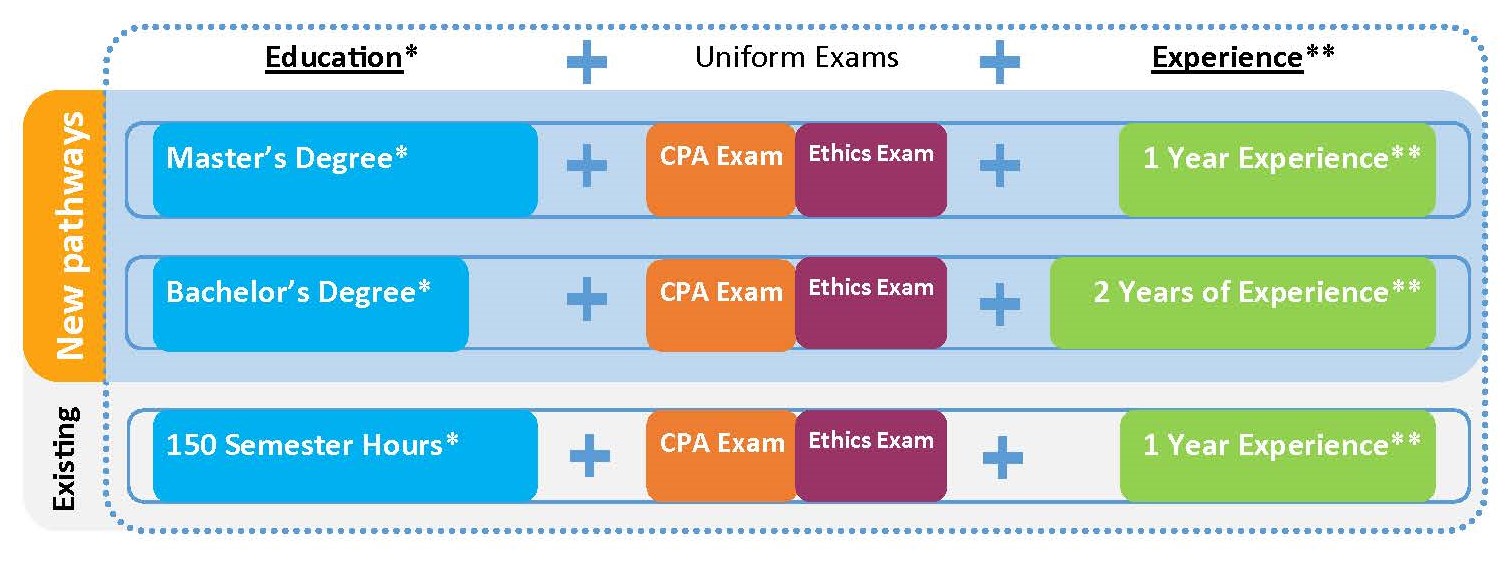

The 2025 MN Legislature passed legislation that creates two new pathways to becoming a CPA. As of January 1, 2026, candidates can qualify for licensure with either a Bachelor's degree + 2 years of experience, or a Master's degree + 1 year of experience. (The current pathway that requires a bachelor’s with 150 semester hours will sunset on June 30, 2030.) Click here for additional information.

The 2025 MN Legislature passed legislation that creates two new pathways to becoming a CPA. As of January 1, 2026, candidates can qualify for licensure with either a Bachelor's degree + 2 years of experience, or a Master's degree + 1 year of experience. (The current pathway that requires a bachelor’s with 150 semester hours will sunset on June 30, 2030.) Click here for additional information.

Candidates may apply using one of these two new pathways on or after January 2, 2026.

Another provision in the legislation broadens interstate practice mobility in Minnesota and is effective immediately.

Changes to Minnesota Statutes, section 326A can be found here: Ch. 326A MN Statutes. Specific changes made during the 2025 session are provided in the box at the top of the page.

The Board of Accountancy has begun rulemaking to conform with the new legislation; check this site for updates.

NASBA Launches CPA Mobile App

The National Association of State Boards of Accountancy (NASBA) has launched the CPA Mobile App for CPA Exam candidates to prepare for, apply to, and stay informed about the Uniform CPA Examination.

The app’s key features include:

• Accessing and downloading the Notice to Schedule (NTS)

• Viewing CPA Exam scores

• Managing payment coupons and international administration fees

• Receiving reminders and alerts for critical deadlines

• Accessing jurisdiction-specific requirements and guidance

• Tracking Exam eligibility and application status

Click here to view the full size flyer.

Rulemaking Notice: Proposed Rules

The Board of Accountancy has launched an active expedited permanent rulemaking project. The purpose of the rulemaking project is to conform to recent changes to Minnesota Statutes, Chapter 326A, concerning requirements for initial licensure and interstate mobility. This rulemaking will potentially affect individuals preparing for initial CPA licensure and licensed CPAs from other states who seek practice privileges in Minnesota.

The Board of Accountancy has launched an active expedited permanent rulemaking project. The purpose of the rulemaking project is to conform to recent changes to Minnesota Statutes, Chapter 326A, concerning requirements for initial licensure and interstate mobility. This rulemaking will potentially affect individuals preparing for initial CPA licensure and licensed CPAs from other states who seek practice privileges in Minnesota.

The proposed rule amendments can be found here.

The Notice of Intent to Adopt Expedited Rules can be found here.

Continuing Professional Education Reporting Fee Chart

Either the left or the right fee column for any given year will apply. If you are noncompliant in more than one year; you owe the applicable fee for each year.

|

|

The following rates are for items postmarked from MARCH 1 to MARCH 31, 2026.

Examples

• Failed to complete CPE for reporting year FY25 on time (6/30/25): $250

• Earned CPE for FY24 and FY25 on time but reported late (after 12/31/24 and 12/31/25 respectively): $500

• Earned FY24 on time but reported late (after 12/31/24) and failed to complete FY25 CPE on time (6/30/25): $650

|

| If you earned the CPE during the proper timeframe but did not report it on time, use these columns: |

|

If you did not earn the CPE on time (and so also did not report it on time), use these columns: |

| Failed to report CPE by*: |

Fee is: |

Submit: |

Failed to complete CPE by**: |

Fee is: |

| 12/31/25 |

$100 |

Certificates of completion for only those hours earned after 6/30/2025 and required fees** |

06/30/25 |

$250 |

| 12/31/24 |

$400 |

Certificates of completion for only those hours earned after 6/30/2024 and required fees** |

06/30/24 |

$550 |

| 12/31/23 |

$700 |

Certificates of completion for only those hours earned after 6/30/2023 and required fees** |

06/30/23 |

$850 |

|

* If you are a non-Minnesota resident claiming exemption from CPE reporting under MN Rule 3100, Subp. 3, you must claim the exemption by the December 31 reporting deadline, or you will be subject to the same fees just as if you were late in reporting the hours.

** If you completed CPE hours after the earning deadline(s) and are requesting carryback, you must include copies of the certificates of completion for those hours. |

The Board of Accountancy has launched an active expedited permanent rulemaking project. The purpose of the rulemaking project is to conform to recent changes to Minnesota Statutes, Chapter 326A, concerning requirements for initial licensure and interstate mobility. This rulemaking will potentially affect individuals preparing for initial CPA licensure and licensed CPAs from other states who seek practice privileges in Minnesota.

The Board of Accountancy has launched an active expedited permanent rulemaking project. The purpose of the rulemaking project is to conform to recent changes to Minnesota Statutes, Chapter 326A, concerning requirements for initial licensure and interstate mobility. This rulemaking will potentially affect individuals preparing for initial CPA licensure and licensed CPAs from other states who seek practice privileges in Minnesota.