Renew for 2025 ASAP!

There Is No Grace Period for Unlicensed Practice

All licenses and permits with an end date of 12/31/2024 have expired. There is no grace period with license or permit expiration. You must be in compliance with Minnesota rules and statutes to hold out or practice.

To renew for 2025, use the appropriate PDF Forms (only Inactive status license holders renewing as Inactive may continue to renew online). See the "Forms" section of the website. Complete the appropriate form and mail in with your check or money order.

If you wish to go Exempt or Retire, or are seeking Reactivation or Reinstatement, see the separate (not Renewal) forms for those statuses/processes in the "Forms" section of the website.

All late renewals or status changes must pay a $50 delinquency fee (per year of expiration), in addition to any license/permit fee.

Those earning and/or submitting CPE late (including those late in reporting exemption from CPE reporting) also have CPE late fees. These accrue monthly, based on the postmarked date the Board receives your certificates of completion and fee. See the CPE chart below for details.

A special reminder to firm owners that 100% of Minnesota-licensed owners must be renewed by March 1, 2025, or the 2025 permit is REVOKED.

NOW HIRING: Executive Director

The Board of Accountancy is seeking qualified individuals to apply for the position of the Board's chief executive administrator. See the Minnesota Career Site (job ID 82019) for more information and how to apply. The posting closes January 6, 2025.

(Please do not contact the Board office; staff will not be able to asist you. Use the link above for details and correct contact information.)

Office Closed January 1 and 20

The Board office is closed Wednesday, January 1, and Monday, January 20, for observed holidays. Online Services remain open.

Rulemaking Notice: Adopted Rules

The Board published in the July 29 2024, issue of the State Register Adopted Rules Governing Examination Credit Requirements and Continuing Professional Education Late Processing Fees, Minnesota Rules, 1105.2000, 1105.2560, and 1105.3000.

The rules are effective as of August 2.

NASBA is working on updating the Candidate Portal, with a projected date of August 15, 2024, at which time candidates can view the impact of the change on their credits.

Do note that the rule change does NOT "extend extensions"; rather, it changes the window of validity both in duration and start date:

- Start date: was "exam sat" date; NOW: score release date

- Duration of validity: was 18 months; NOW 30 months

Some individuals will find that a credit previously expired has time left under the new rule/window. Some who received the June 30, 2025, extension may find that their credit has an expiration date yet further out under the 30-month rule. Others will find that the June 30, 2025, extension they received (or a different extension request granted by the Board) remains their credit expiration date.

As circumstances will vary so uniquely to each individual, wait for and review your scores in the NASBA Candidate Portal once the changes go live there on August 15, 2024.

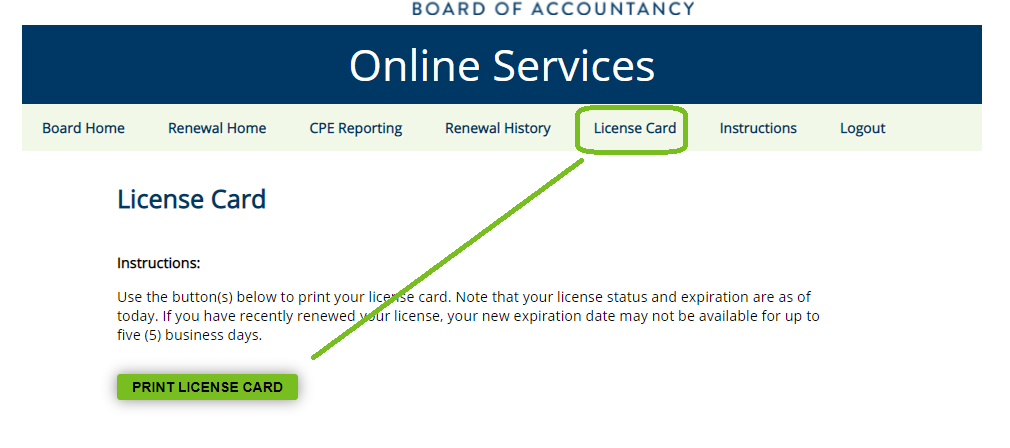

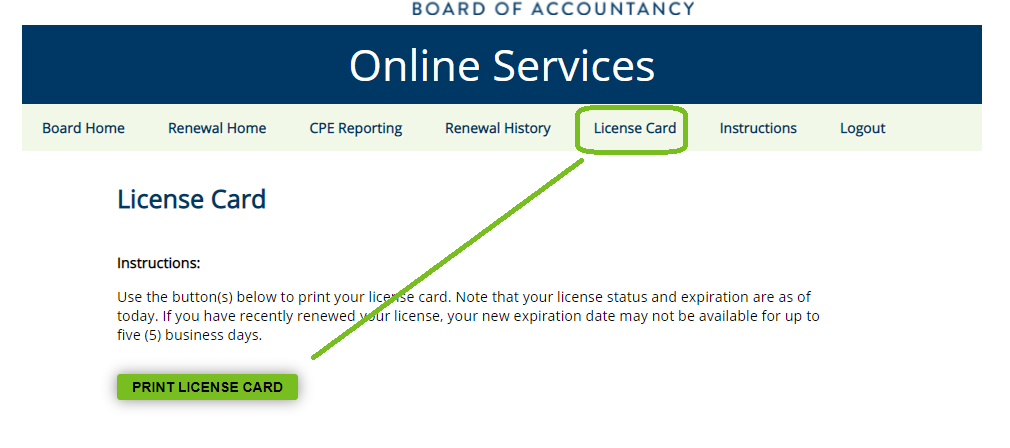

License Cards for Current CPA Licensees and SP Firms Available Through Online Services

The Board does not mail license or permit cards upon renewal. Current Active and Inactive status licensees may instead log into Online Services and print a PDF version of their license card. Sole proprietors whose firm permit number is the same as their individual license number can also print a copy of their firm permit.

Log in to Online Services, then select the "License Card" tab (see image). If a card is available, you will see a "print" option. Note that if you have only just recently renewed or become licensed, the card may not be available (or may not show your new expiration date) for 3-5 business days.

When you select "print" a PDF is generated. Where the file saves or how it displays will depend upon the browser/browser settings you use. Lines on the 8 1/2 x 11 printout indicate where to cut to create the traditional oversized and wallet-sized cards.

No license/permit cards are available for CPA firms or RAPs/RAP firms. To verify your status and expiration, use Find a CPA (individuals) and Find a CPA Firm (CPA and RAP firms).

Beware of Email Phishing

The Minnesota Board has learned that a phishing message claiming to be from the Minnesota Board regarding "licensee fee changes" has been circulating. The Board sent no such message (and there are no fee increases). If received, follow the best practices at your firm for dealing with suspicious emails.

Continuing Professional Education Reporting Fee Chart

Either the left or the right fee column for any given year will apply. If you are noncompliant in more than one year; you owe the applicable fee for each year.

Examples (rates valid only for JANUARY 2025):

• Failed to complete CPE for reporting year FY24 on time (6/30/24): $200

• Earned CPE for FY23 and FY24 on time but reported late (after 12/31/23 and 12/31/24 respectively): $400.

• Earned FY23 on time but reported late (after 12/31/23) and failed to complete FY24 CPE on time (6/30/24): $550.

|

| Reported CPE late but earned the CPE during the proper timeframe, use these columns: |

|

Failed to complete CPE in proper timeframe (and so also did not report it on time), use these columns: |

| Failed to report CPE by*: |

Fee is: |

Submit: |

Failed to complete CPE by**: |

Fee is: |

| 12/31/24 |

$50 |

|

06/30/24 |

$200 |

| 12/31/23 |

$350 |

Certificates of completion for only those hours earned after 6/30/2023 and required fees** |

06/30/23 |

$500 |

| 12/31/22 |

$650 |

Certificates of completion for only those hours earned after 6/30/2022 and required fees** |

06/30/22 |

$800 |

| 12/31/21 |

$950 |

Certificates of completion for only those hours earned after 6/30/2021 and required fees** |

06/30/21 |

$1100 |

|

* If a non-Minnesota resident claiming exemption from CPE reporting under MN Rule 3100, Subp. 3, you must claim the exemption by the reporting deadline or be subject to the same fees as those late reporting hours.

** If you completed CPE hours after the earning deadline(s), you must include copies of the certificates of completion for those hours. |